| MMA Derivative | |

|---|---|

|

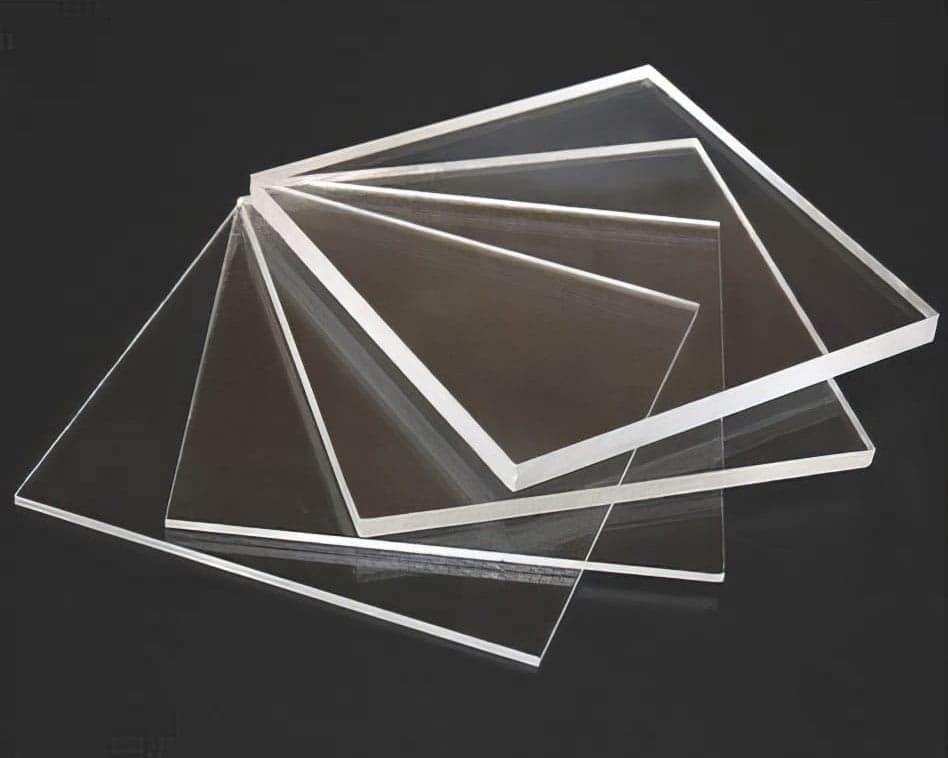

Polymethyl-methacrylate (PMMA)

|

Impact resistant glass replacement ("organic" glass)

Molded / extruded goods (e.g. car tail lights) |

| MMA-Styrene-Butadiene ter-polymers | PVC impact modifiers |

Growth in MMA demand typically follows gasoline demand growth on a global basis. Asia accounts for more than half of world supply and demand and China more than half of Asian demand. Global growth in MTBE demand will predominantly be in China.

MMA can be made from a variety of different production technologies, with the predominant commercial method utilizing a C3 process. Other, more competitive processes have been developed with isobutylene and ethylene. MMSA maintains economic snapshots of MMA production costs.

MMA trade is currently characterized by imports into China, Korea, Taiwan as well as a number of SEA countries. Japan and Southeast Asia are major exporters. China is a dominant MMA importer. The US is a net exporter of MMA. PMMA and other MMA derivatives are also traded in large quantities, typically as part of prefabricated parts made in developed countries. A trade matrix showing MMA trade by MMSA region and country listings can be provided to clients separately.

MMSA maintains a detailed global database of MMA producers and consumers, as well as global supply and demand balances and forecasts through 2050. It has provided one-off, proprietary studies into this global industry and specific companies operating within it. MMSA can assist companies or financial institutions with existing investments or looking to make future investments in this industry. MMSA can provide an efficient and objective assessment of the outlook for that investment in several forms:

Market (Supply and Demand) Analysis

-

- Price Outlook / Margin Analysis

-

- Technology Review

-

- Valuation

-

- Viability, Pre-Feasibility Assessments