The manufacture of acetic acid consumed 7.7% of the 98.3 million metric tons of methanol produced in 2019. Acetic acid is a well-developed intermediate used in several successful commercial chemical processes as both chemical intermediate and solvent. Eventual applications for acetic acid derivatives include latex emulsion resins for paints, adhesives, paper coatings, textile finishing agents, cellulose acetate fibers, cigarette filter tow, and cellulosic plastics. It is also found in ocean water, oilfield brines, rain, and at trace concentrations in many plant and animal liquids. It is central to all biological energy pathways. In its pure form, acetic acid is corrosive and characterized by its sharp odor, burning taste, and harmful blistering properties.

Other names for acetic acid include glacial acetic acid, ethanoic acid, ethylic acid, methanecarboxylic acid, and vinegar acid.

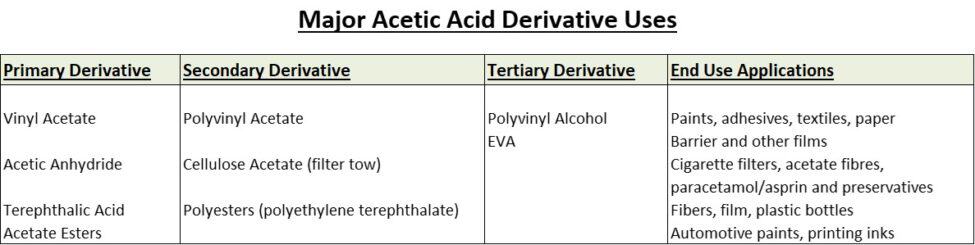

Like formaldehyde, acetic acid follows a number of commercial pathways leading to significant commercial final goods. The table below describes the major derivatives of acetic acid and their intended uses:

From this list, it is clear that drivers for acetic acid are mostly non-durable and disposable goods (e.g. paints, adhesives, cigarette consumption, aspirin, fibers, plastic bottles).

The chart below shows acetic acid consumption estimates globally by end use for 2018E. VAM and TPA have played an important role in global acetic acid demand growth. VAM has benefited from strong consumer demand globally, and TPA demand has been accelerating because of the growth of polyester demand, mostly for the production of plastic bottles, but also in fiber applications. The other major consumers of acetic acid show positive, although slower, growth.

Markets

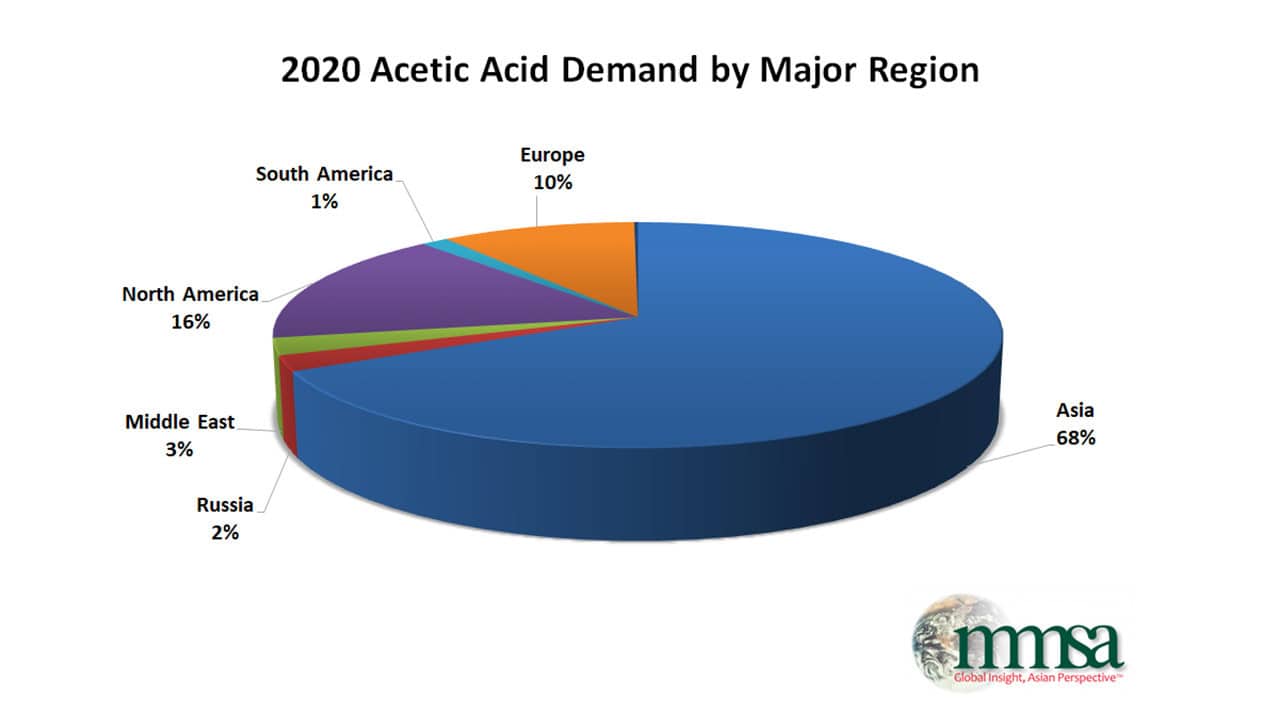

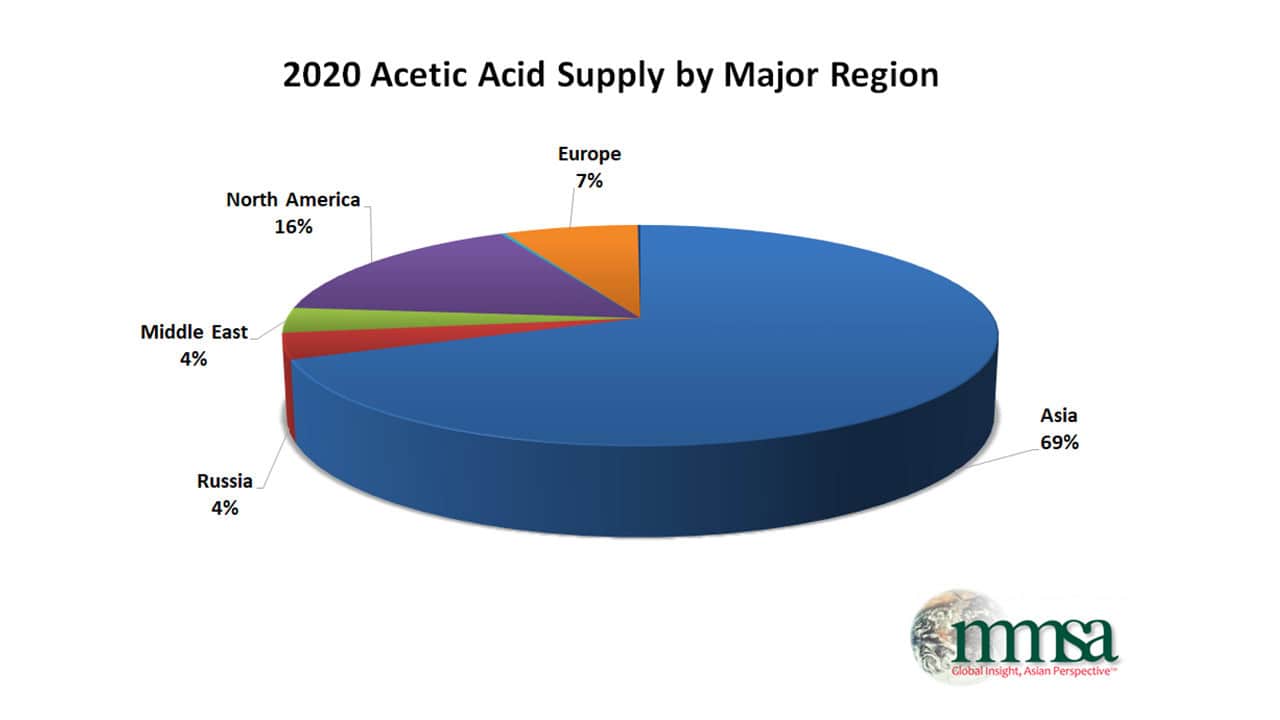

The pie charts below break down the regional distribution of acetic acid supply and demand. It is clear that the Asian region, lead by China, has provided the most demand growth for acetic acid in recent history. This is particularly the case for TPA, as China has been adding significant polyester production capacity to meet rapidly growing demand associated with its WTO participation, and is investing upstream in new TPA capacity as well. Additionally, acetate esters (oxygenated solvents) are growing in China as reductions in chlorinated and hydrocarbon solvents are enacted. In other regions of the world, demand growth has been much more moderate, ranging from flat to slightly positive for non-Asian regions.